If your portfolio is invested 25 percent each in A and B and 50 percent in C what is the portfolio expected return. That is all of the correlation coefficients are between 0 and 1 Expected StandardStock Return Deviation BetaStock A 10 20Stock B 10 20Stock C 12.

/dotdash_final_Optimize_Your_Portfolio_Using_Normal_Distribution_Jan_2021-01-7b5b43d1e34d44229a3bd4c02816716c.jpg)

Optimize Your Portfolio Using Normal Distribution

Portfolio ABC has one third of its funds invested in each of the three stocks.

:max_bytes(150000):strip_icc()/FourStepstoBuildingaProfitablePortfolio-171c087dc41f40269547e95a0b60eab5.png)

. The portfolio is invested 40 percent in each Stock A and Stock B and 20 percent in Stock C. If the expected T-bill rate is 403 percent what is the expected risk premium on the portfolio. Consider the following information for three stocks A B and C.

If your portfolio is. The risk-free rate is 55 and the market is in equilibrium. Consider the following information on a portfolio of three stocks.

Consider the following information on a portfolio of three stocks. Consider the following information for Stocks A B and C. Consider the following information about three stocks.

C what is the portfolios expected return. Expected Standard Stock Return Deviation Beta A 10 20 10 B 10 10 10 C 12 12 14 Portfolio AB has half of its funds invested in Stock A and half in Stock B. If Consider the following information on a portfolio of three stocks.

Tyler Trucks stock has an annual return mean and standarddeviation of 10 percent and 45 percent respectively. Consider the following information for three stocks Stock A Stock B and Stock C. Consider the following information on a portfolio of three stocks.

The stocks returns are positively but not perfectly positively correlated with one another ie the correlations are all between 0 and 1. What is the market risk premium. Consider the following information about three stocks.

If the returns on two stocks are perfectly positively correlated ie the correlation coefficient is 10 and these stocks have identical standard deviations an equally weighted portfolio of the two stocks will have a standard deviation that is less than that of the individual stocks. Assume you create your own portfolio and the weightage of the portfolio for the following stock is as follows. The risk-free rate is 5 and the market is in equilibrium so required returns equal expected returns.

Picture 6 The portfolio is invested 40 percent in each Stock A and Stock B and20 percent in Stock C. That is eachof the correlation coefficients is between 0 and 1. Nigeria Economy Probability of Happening stock A stock B stock.

Yourportfolio allocates equal funds to Tyler Trucks stock and MichaelMoped Manufacturing stock. See the answer See the answer done loading. Michael MopedManufacturing stock has an annual return mean and standarddeviation of 104 percent and 51 percent respectively.

That is required returns equal expected returns a. A Portfolio ABCs expected return is 1066667. Expected Standard Stock Return Deviation Beta A 10 20 10 B 10 10 10 C 12 12 14 Portfolio AB has half of its funds invested in Stock A and half in Stock B.

That is each of the correlation coefficients is between 0 and 1 begin matrix text Stock text Expected Return text Standard Deviation text Beta text A text 955 text 15 text 09. Portfolio ABC has one. If your portfolio is invested 40 percent each in A and B and 20 percent in C what is the SolutionInn.

The portfolio is invested 40 percent in each of Stock A and Stock B and the rest in Stock C. Consider the following information on a portfolio of three stocks. What is the expected return on this portfolio.

What is the expected return on an. Up to 256 cash back Consider the following information. If your portfolio is invested 42 percent each in A and B and 16.

Expected Standard Stock Return Deviation Beta A 10 20 10 B 10 10 10 C 12 12 14 Portfolio AB has half of its funds invested in Stock A and half in Stock B. If the expected T-bill rate is 370 percent what is the expected risk premium on the portfolio. If the expected T-bill rate is 410 percent what is the expected risk premium on the portfolio.

If the expected T-bill rate is 375 percent what is the expected risk premium on the portfolio. 50 of stock A 30 of stock B and 20 of stock C. Consider the following information on three stocks.

Consider the following information about three stocks. The returns on each of the three stocks are positively correlated but they are not perfectly correlated. If the T-bill rate is 403 percent what is the expected risk premium on the portfolio.

Value of Stock A in portfolio 165 90 Value of Stock A in portfolio 14850 Value of Stock B in portfolio 140 106 Value of Stock B in portfolio 14840 total value of portfolio 14850 14840 total value of portfolio 29690 Weight of A 14850 29690 5002 Weight of B 14840 29690 4998. Answer to Consider the following information on a portfolio of three stocks. Consider the following information on a portfolio of three stocks.

Fund P has one-third of its funds invested in each of the three stocks. Consider the following information for three stocks Stocks AB and C. If the expected T-bill rate is 403 percent what is the expected risk premium on the portfolio.

State of Economy Probability of State of Economy Rate of Return If State Occurs Stock A Stock B Stock C Boom 25 21 36 55 Normal 60 17 13 09 Bust 15 00 28 45 a. State of Probability of State Rate of Return if State Occurs Economy of Economy Stock A Stock B Stock C Boom 73 11 05 41 Bust 27 30 36 â 21 a. 768 percent 538 percent 672 percent 690 percent 580 percent.

If your portfolio is invested 40 percent each in A and B and 20 percent in C what is the portfolio expected. Rate of Return If State Occurs Probability of State of State of Economy Stock A Stock B Stock C Economy 25 Вoom 21 33 55 Normal 60 17 11 09 Bust 15 00 -21 -45 a-1If your portfolio is invested 40 percent each in A and B and 20 percent in C what is the portfolio expected return. If your portfolio is invested 40 percent each in A and B and 20 percent in C what is the portfolio expected return.

Which of the three stocks has the lowest risk. Required Return on Stock Risk-Free Return Market Risk Premium Stocks Beta 955 55 Market Risk Premium 09 405 Market Risk Premium. Finance questions and answers.

State of Economy Probabllity of State of Economy 12 52 136 Boom Normal Bust - Stock A Stock B Stock C Rate of Return Rate of Return Rate of Return 05 35 57 13 15 23 19 14 -38 a. Portfolio ABC has one third of its funds invested in each of the three stocks. Consider the following information about three stocks.

The returns on the three stocks are positively correlated but they are not perfectly correlated. Which of the following statements is CORRECT. If you formed a portfolio that consisted of all stocks with betas less than 10 which is about half of all stocks the portfolio would itself have a beta coefficient that is equal to the weighted average beta of the stocks in the portfolio and that portfolio would have less risk than a portfolio that consisted of all stocks in the market.

The returns on the three stocks are positivelycorrelated but they are not perfectly correlated. Which of the following statements is CORRECT. What is the standard deviation of returns on the portfolio.

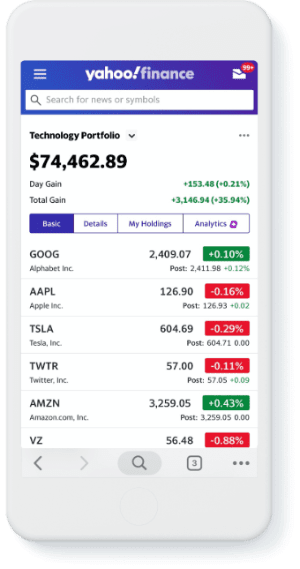

Stock Portfolio Tracker Yahoo Finance

:max_bytes(150000):strip_icc()/conservativeportfolio-tardi-d19760c073f44c5b94bf060071963751.jpg)

/AchieveOptimalAssetAllocation-01_2-8450dfb785a04b43b234ca4c050396db.png)

0 Comments